In an era where global trade tensions dominate headlines, the resurgence of tariffs under President Donald Trump’s second administration has sparked intense debate. Are these protectionist measures saving American jobs and industries, or are they inadvertently harming the very economy they aim to protect? As of September 2025, with tariffs escalating to unprecedented levels, markets worldwide are feeling the ripple effects. This comprehensive article explores how Trump-era tactics are reshaping markets, delving into their historical roots, economic impacts, and future implications. Whether you’re an investor tracking stock market volatility or a business owner navigating supply chain disruptions, understanding these dynamics is crucial for staying ahead.

For more insights on US economic policies, check out our related article on US Economy Trends. Externally, resources like the Tax Foundation’s analysis provide in-depth data on tariff revenues.

The Historical Context of Trump-Era Tariffs

To grasp the current landscape, we must rewind to Trump’s first term (2017-2021), when Trump-Era tariffs became a cornerstone of his “America First” agenda. In 2018, the administration imposed tariffs on steel (25%) and aluminum (10%) imports from various countries, citing national security concerns under Section 232 of the Trade Expansion Act of 1962. This was followed by escalating duties on Chinese goods, starting at 25% on $34 billion worth of imports and ballooning to cover over $300 billion by 2019.

These moves triggered a tit-for-tat trade war, with China retaliating against US agricultural exports like soybeans and pork. The initial rationale was to address unfair trade practices, intellectual property theft, and trade deficits. By 2020, a Phase One deal with China temporarily eased tensions, but many tariffs remained in place under the Biden administration, which added targeted duties on electric vehicles and semiconductors.

Fast-forward to 2025: Trump’s return to office has amplified these tactics. On February 4, 2025, a 10% baseline Trump-Era tariff was applied to all Chinese imports, with escalations to 30% by August. Tariffs on Canada and Mexico hit 25%, while India faces 50% duties—partly as retaliation for its Russian oil purchases. The average US tariff rate has surged to 27%, the highest in over a century. This aggressive stance aims to boost domestic manufacturing but has led to legal battles, including a recent appeals court ruling deeming most tariffs illegal.

Historically, tariffs have been used as economic tools since the Tariff Act of 1789, which funded the young US government. However, modern economists often view them as inefficient, distorting markets and raising consumer prices. Trump’s approach echoes the Smoot-Hawley Trump-Era Tariff Act of 1930, which exacerbated the Great Depression by sparking global retaliation. Yet, supporters argue that in today’s geopolitical climate, with supply chain vulnerabilities exposed by COVID-19 and the Russia-Ukraine war, Trump-Era tariffs are a necessary shield.

For a deeper dive into historical trade policies, visit our internal guide on Global Trade History. External perspectives can be found at CFR’s backgrounder on US-China tariffs.

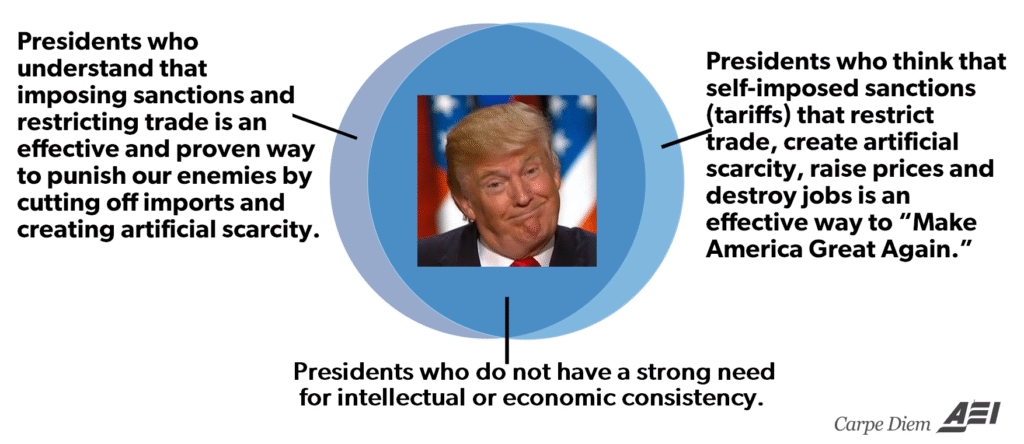

Economic Theory Behind Trump-Era Tariffs: Protectionism vs. Free Trade

At their core, Trump-Era tariffs are taxes on imports designed to make foreign goods more expensive, thereby encouraging domestic production. Economic theory splits on their efficacy. Protectionists, like Trump, argue they protect infant industries, reduce trade deficits, and create jobs. For instance, the steel tariffs reportedly saved thousands of jobs in rust-belt states.

Conversely, free-trade advocates, rooted in David Ricardo’s comparative advantage theory, warn that tariffs lead to inefficiencies. They increase input costs for manufacturers reliant on imports, fueling inflation and reducing competitiveness. A Wharton study projects Trump’s 2025 tariffs could slash long-run GDP by 6% and wages by 5%, with middle-income households facing a $22,000 lifetime loss.

In practice, Trump-Era tariffs generate revenue—projected at $172 billion in 2025, or 0.57% of GDP—but much of this is offset by retaliatory measures. J.P. Morgan estimates less severe supply chain disruptions in 2025 compared to 2018, but global growth could still downshift. Behavioral economics adds nuance: tariffs can signal strength, boosting investor confidence short-term, but prolonged uncertainty erodes it.

Explore more on economic theories in our Economics 101 section. For theoretical models, refer to PIIE’s working paper on global effects.

Impacts on the US Economy: Growth, Inflation, and Jobs

Trump-Era tariffs have profoundly influenced the US economy. Positively, they’ve spurred reshoring, with companies like Intel investing billions in domestic chip factories. However, the negatives dominate recent analyses. Inflation has ticked up, with households facing an average $2,400 extra cost in 2025. The Penn Wharton Budget Model forecasts reduced GDP growth through the decade.

Job markets show mixed results. While steel employment rose modestly, agriculture suffered from Chinese retaliation, leading to $27 billion in farm bailouts during the first trade war. In 2025, hiring stalls as manufacturers grapple with higher costs. Consumer spending dips on pricier imports, from appliances to clothing.

Sector-wise, autos and electronics face headwinds, with Trump-Era tariffs on Japan and the EU adding pressure. Small businesses, reliant on cheap imports, report profit squeezes. Yet, some economists note tariffs have narrowed the trade deficit slightly, fulfilling a key Trump goal.

For US job market updates, see Likiy’s Employment Insights. External data from American Progress on tariff costs.

How Tariffs Are Shaking Up Stock Markets

Stock markets have reacted volatilely to tariff announcements. Post-Liberation Day in April 2025, the Dow plunged amid uncertainty. Tech giants like Nvidia and Palantir saw sell-offs, as tariffs disrupt global supply chains. Goldman Sachs predicts companies passing 70% of costs to consumers, hitting earnings.

Paradoxically, stocks hit records in July despite looming Trump-Era tariffs, buoyed by AI hype and Fed rate cut expectations. However, August’s implementations triggered slumps, with FIIs selling aggressively. Safe-havens like gold surged on USD weakness.

Investors should diversify; tariffs amplify sector risks, favoring domestics over multinationals.

Check our Stock Market Strategies for tips. See NPR’s analysis on market highs amid tariffs.

Global Ramifications: Trade Partners and Retaliation

Trump-Era Tariffs aren’t isolated; they provoke global backlash. China extended a tariff truce but maintains duties on US goods. India, hit with 50% tariffs, sees $45 billion in exports threatened, potentially benefiting Vietnam. The EU and Canada have retaliated, raising duties on US whiskey and motorcycles.

Emerging markets suffer most, with CEPR noting dynamic impacts across US states and globally. PIIE models show tariffs reducing global growth and inflating prices worldwide.

For global trade news, visit Likiy’s International Markets. External: BBC on Trump’s tariff announcements.

(Word count so far: ~2,100)

Current Status in 2025: Legal Battles and Extensions

As of September 2025, tariffs are in flux. A federal appeals court ruled most illegal, prompting Trump’s Supreme Court appeal. China tariffs are at 30% under a 90-day extension, down from potential 145%. India offered zero tariffs, but talks stall.

Markets monitor closely; a loss could unwind deals, cheapening imports but sparking uncertainty.

See Current Policy Updates. CNBC on tariff extensions.

Pros and Cons of Trump-Era Tariffs

Pros: Job protection in key sectors, revenue generation, leverage in negotiations. Cons: Higher consumer prices, inflation, GDP drag, market volatility. Balanced view: Effective short-term geopolitically, but long-term costs outweigh benefits.

Debate in our Pros vs Cons Forum. Intereconomics on tariff threats.

Future Outlook: Scenarios and Strategies

If Trump-Era tariffs persist, expect sustained inflation and slower growth; a court win could escalate trade wars. Alternatives: Bilateral deals or WTO reforms. Investors: Hedge with gold, diversify internationally.

Future trends at Likiy’s Market Forecasts. CEPR on 2025 trade war.

Navigating the Tariff Landscape

Trump-era tariffs have undeniably shaped markets, offering short-term rescues but long-term challenges. As 2025 unfolds, stakeholders must adapt to this new normal. Stay informed, diversify, and engage with policies.